private placement life insurance canada

Life Insurance Coverage In 3 Easy Steps. Private Placement Life Insurance PPLI is a variable universal life insurance product designed for.

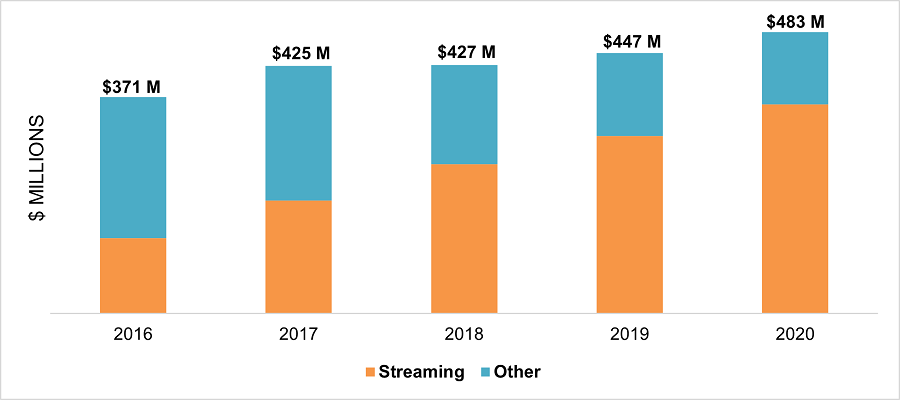

2021 Study Of The Economic Impacts Of Music Streaming On The Canadian Music Industry Canada Ca

Variable or indexed life insurance is a form of life insurance that has cash value linked to the performance of one or more investment accounts within the policy.

. Because of their considerable assets high-net-worth. The death benefit refers to the amount of money your beneficiaries. The death benefit paid from a life insurance policy is a tax-free lump-sum amount that can be used to.

As one of Canadas leading financial services companies we take pride in making disciplined purposeful long-term investments. From 15 A Month. Private placement life insurance PPLI in contrast is a privately negotiated life insurance contract between insurance carrier and policy owner.

Private Placement Life Insurance can be a very powerful solution for the right client and typically they have to have. What is participating life insurance. Because of its investment features insurance carriers in the United States typically register offerings of variable life insurance with federal and state securities regulators.

Ad Term and Whole Life Insurance You Can Rely On. All in all private placement life insurance is income tax efficient while providing the owner with tax-free access to the policy cash values. PPLI offers several advantages.

2022s Top Life Insurance Providers. Your breakdown of the weeks need-to-know financing opportunities warrants flow throughs and more. Ad Compare the Best Life Insurance Providers.

It has many advantages but it also has limitations. Often shortened to PPLI Private Placement Life Insurance was. For those who have at least a few million dollars and have a high income Private Placement Life Insurance is advisable.

Ad PIPSC Members join ServicePlus for free to get group life insurance. Winged Keel Group is widely recognized as one of the leading experts in the structuring and administration of Private Placement Life Insurance and Annuity Investment. Private placement life insurance is a very powerful solution for the right wealthy clients in the right circumstances.

Weve worked with GreatWest Life to take advantage of our size to offer exceptional rates. QA Private Placement Life Insurance What is Private Placement Life Insurance. Payable to your designated beneficiary ies in the event of your death.

2022 Reviews Trusted by 45000000. A high Net Worth. Because of the tax benefits the very.

In Canada Canada Life manages over 125 billion in assets. Its lifelong coverage that pays whomever you choose a tax-free payment when you die. Life insurance can help your loved ones deal with the financial impact of your death.

After you die your beneficiaries will receive the death benefit. As part of a life insurance policy assets may grow. The ability to fund 20m or more in.

Private placement life insurance is a type of variable universal life VUL insurance1that allows investments contained within the policy to grow with income and capital gains taxes deferred. Private placement life insurance PPLI provides another solution. Trusteed For Over 100 Years.

Universal life insurance is a type of permanent life insurance that ties your cash value growth in the policy to. Lump-sum benefit equal to your annual salary rounded to the nearest 1000. Reviews Trusted by 45000000.

Private placement life insurance is a type of variable universal life VUL insurance1that allows investments contained within the policy to grow with income and capital. Permanent life insurance covers you throughout your life. Your policy is guaranteed to grow in cash value as long as you pay.

Keep informed with our Weekly Wire newsletter. Private placement life insurance is a type of universal life insurance. Private placement life insurance or PPLI is a customized version of variable rate insurance not available to the general public.

A single premium life policy it provides wealthy clients with high value life cover whose death benefit. A properly established PPLI policy could provide qualified investors with tax-free wealth growth and estate protection. To register the offering carriers typically need to provid.

Fewer Canadians Have Disability Coverage Through Workplace Benefits Leaving Them More At Risk

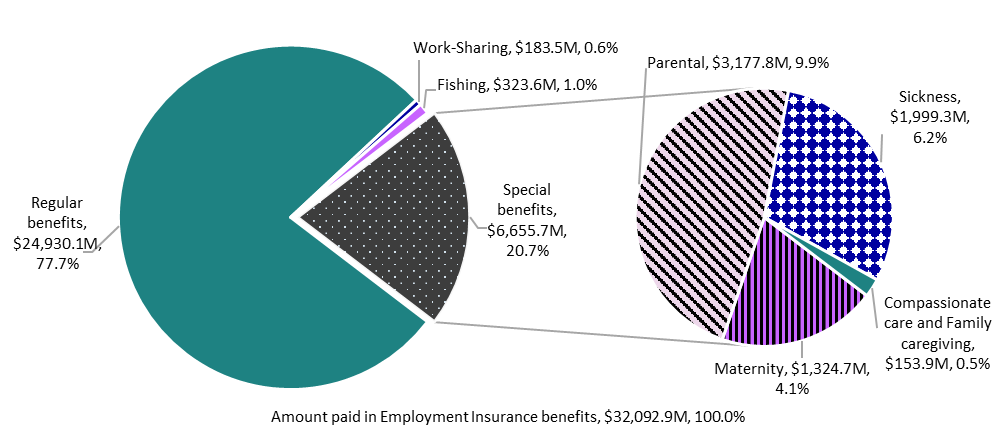

Chapter 2 Impact And Effectiveness Of Employment Insurance Benefits Part I Of The Employment Insurance Act Canada Ca

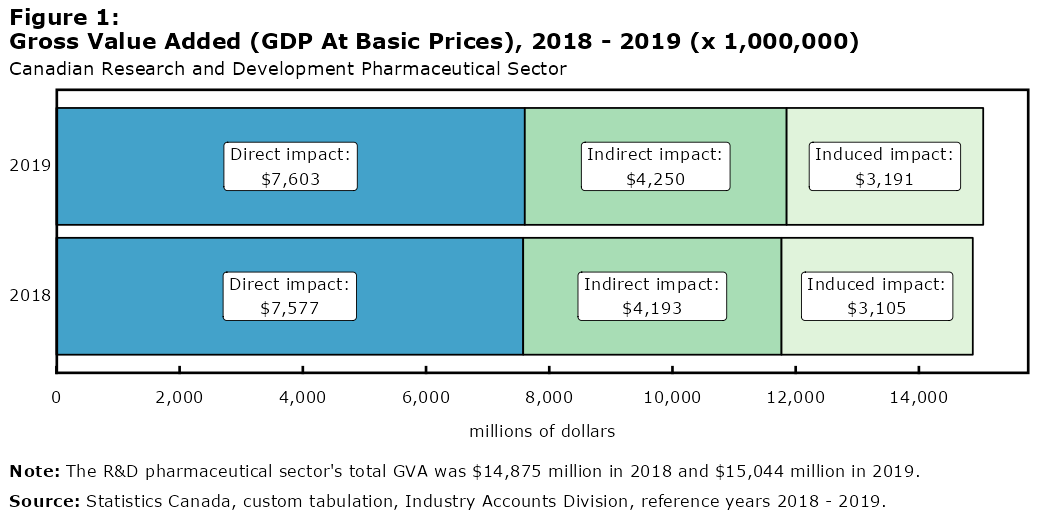

The Canadian Research And Development Pharmaceutical Sector 2019

Life Insurance Through Work Benefits Does It Provide A False Sense Of Security

Are Your Paying Too Much For Your Health Insurance Get A Free Quote And Find Out Today Philadelphia American Health Insurance For Your Health Free Quotes

Brands Businesses Who Want To Be Girlfriend Recommended Marketing Advertising Infographic Business Branding

Canada Life Introduces New Brand To Canadians Through First Ever National Mass Media Campaign

The Canadian Research And Development Pharmaceutical Sector 2019

Life Insurance Through Work Benefits Does It Provide A False Sense Of Security

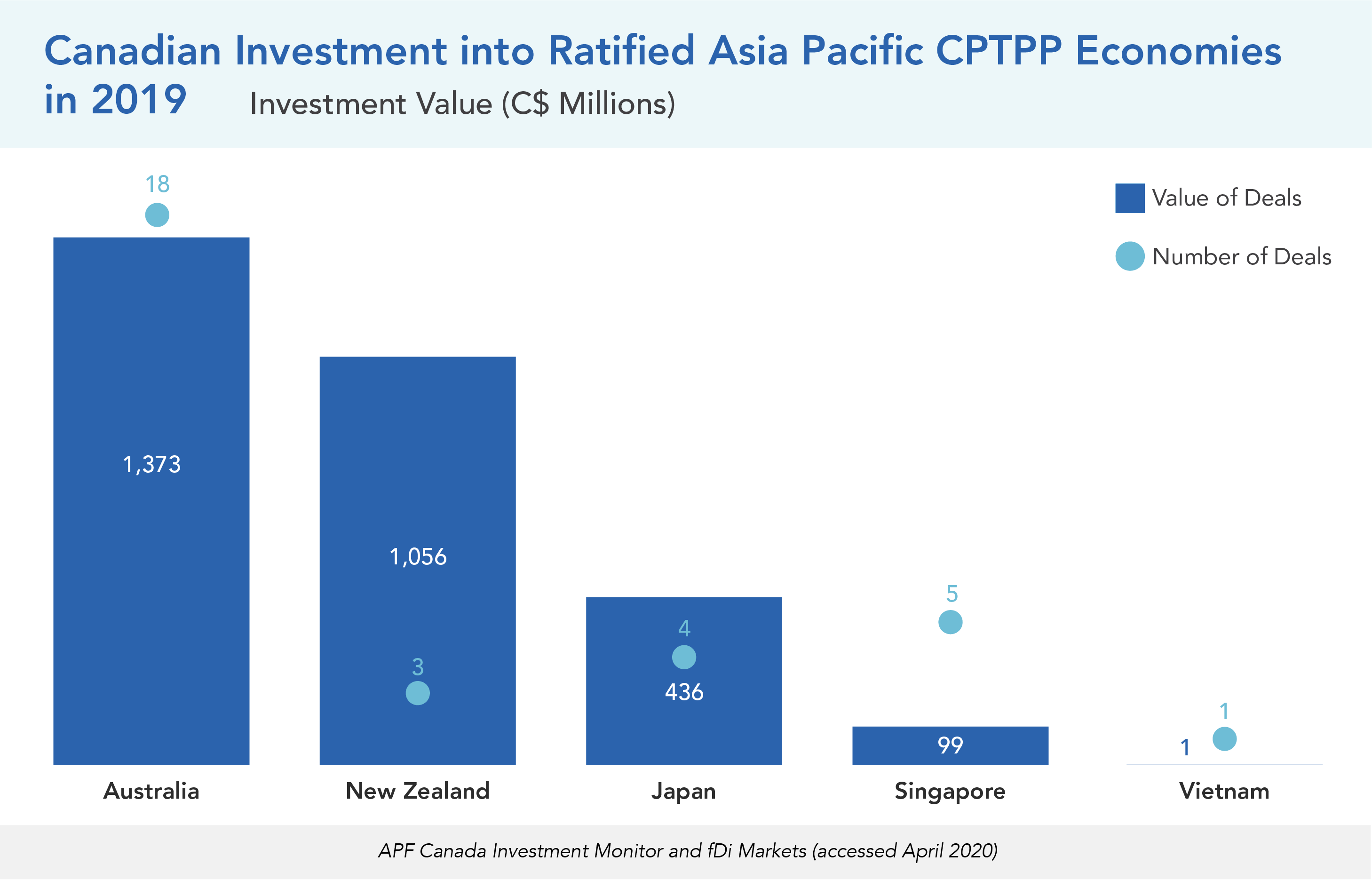

Annual Report 2020 Trade Agreements And Foreign Investment In The Asia Pacific Investment Monitor

Canada S Hottest Fintech Lending Trends For 2022 Revealed In Latest Research

Hot Jobs The 100k Entry Level Job You Can Get Here In Canada National Globalnews Ca

The Five Big Questions You Need To Ask About Your Workplace Disability Insurance Coverage

What Makes An International Student Select A Particular Course And Not The Others Let S Find Out Studyabroa Graduate Studies Phd In Education Study Abroad

The College Of St Michel Is Offering Free Health Insurance Free Food Tuition Fees

Work Eligibility International Conestoga College

Whole Life Insurance And Taxes Everything You Must Know

The Canadian Research And Development Pharmaceutical Sector 2019